On Monday, China released powerful GDP growth and other economic data. Meanwhile, the Chinese President confirmed a historic 3rd term with the cessation of a key political meeting. But the foreign investors were frightened and ditched Chinese assets in overseas markets. Most of them were concerned about Xi’s strong grip on power.

Moreover, investors believe the powerful grip on the Chinese President could increase Beijing’s existing policies. On Monday, the National Bureau of Statistics issued a statement. The Chinese GDP was boosted by 3.9% in the 3rd quarter compared to the last year. It defeated market expectations, which was estimated to grow by around 3.4%.

Shanghai is a Key Global Trade Hub

However, the Chinese economy was abused during Covid-19, but it marked an uplift from the 0.4% increase in the 2nd quarter. Shanghai is considered the financial center of the nation and a central global trade hub. But it experienced a shutdown for 2 months in the months of April and May 2022. The newly released 3.9% GDP was significantly below the initially targeted annual official growth rate.

The senior Chinese economist for Capital Economics, Julian Evans-Pritchard, said in a research report that the perspective remains overcast. However, there isn’t any anticipation of the Chinese uplifting its zero-Covid policy in a short time. Julian added that he doesn’t expect any consequential refreshments before 2024. All the breezes will preserve to stress the Chinese economy.

Chinese Economy Could Boost to 3.5%

However, Julian is hopeful that the official GDP of China could boost to 2.5% in 2022 and around 3.5% in 2023. The economic GDP data was initially scheduled to be released on October 18 but came out after a week of delay. The Chinese Communist Party conducted its twice-in-a-decade party conference from October 16 to October 22, 2022.

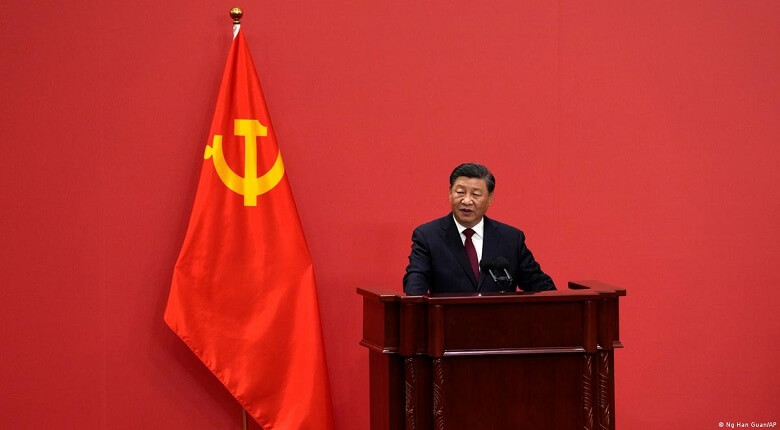

The Chinese President secured a pattern-breaking 3rd term as the party head during the conference. He also added a new leadership team with his steadfast followers which showed his stronger grip on power. Some key economic officials who were supportive of market reforms and opening up the economy weren’t included in the new leadership.

Hang Seng Index of Hong Kong Dropped on Monday

It has now initiated concerns about the perspective of shadowing the economy of China. Some of the missing names include the Governor of the Central Bank Yi Gang, Premier Li Keqiang, and Vice Premier Liu He. The HIS, Hang Seng Index of Hong Kong dropped on Monday and moved to its major losses. However, the Index is a major evaluation of overseas investor viewpoint on China.

The Chief Asian Forex strategist at Mizuho Bank, Ken Cheung, issued a statement. He said the leadership reshuffle has significantly frightened foreign investors to pull their Chinese investment. It also sparked massive sell-offs in the Hong Kong-listed Chinese assets. However, some analysts said the new leadership is unable to predict well from an economic perspective.

Common Prosperity is a Campaign

Cheung said the market participants supposed the implications as the policy continuation and power combination of President Xi. The foreign investors were supposedly concerned regarding the increase of existing policies and the increasing China-US tension. The head of emerging markets strategy at TD Securities, Mitul Kotecha, issued a statement.

Kotecha said the evaporation of pro-reform officials from the new leadership foreshadows the future of the Chinese private sector. The termination of existing officials and reformers from the PSC and replacement could override the push of officials. Meanwhile, common prosperity is a campaign to redistribute wealth to decrease the gap between rich & poor people.